(Montreal, July 13, 2022) Osisko Metals Incorporated (the “Company” or “Osisko Metals“) (TSX-V: OM; OTCQX: OMZNF; FRANKFURT: 0B51) is pleased to announce the results of the Updated Preliminary Economic Assessment (the “PEA Update”) for its wholly-owned Pine Point Project (the “Project”), located near the town of Hay River in the Northwest Territories, Canada. The PEA Update was prepared in collaboration with independent engineering firms BBA Inc., WSP Canada Inc., & Hydro-Resources Inc. (“HRI”).

The objective of the 2022 PEA Update was to integrate updated long-term prices for zinc and lead, increased mined resources, cost escalations in CAPEX and OPEX as well as reduced life-of-mine water management costs that resulted from the recently completed hydrogeological model. The latter reduced the estimated dewatering volume by 30% compared to the 2020 PEA with potential for a further forecasted reduction of 15% as the project advances to feasibility.

Table 1: Updated PEA Highlight Results

(all figures in CAN$ unless otherwise noted)*

| After-Tax Internal Rate of Return (“IRR”) | 25% |

| After-Tax Net Present Value (“NPV”) (Discount Rate 8%) | $602M |

| After-Tax Payback Period (Years) | 3.8 |

| Pre-Production CAPEX (including $106.6M Contingency) | $653M |

| Average Annual LOM Production Zinc | 329Mlb |

| Average Annual LOM Production Lead | 141Mlb |

| Life of Mine (“LOM”) | 12 Years |

| Total Mineral Resources Mined | 46.9Mt |

| Average ZnEq Diluted (12%) Grade of Mineral Resources Mined | 6.1% |

| Gross Revenue After Royalty (LOM) | $5,625M |

| After-tax Operating Cash Flow (LOM) | $1,279M |

| C1 Costs over LOM (ZnEq)** | US$0.61/lb |

| All-In Costs (including sustaining CAPEX, ZnEq)*** | US$0.80/lb |

| LOM Zinc Price | US$1.37/lb |

| LOM Lead Price | US$0.96/lb |

| FX Rate (CAD:USD) | 1.27 |

* See Cautionary Statement below

** C1 cost includes mine site cost plus smelting, transport and royalty

*** All-in costs are C1 plus sustaining CAPEX

Robert Wares, Executive Chairman & CEO, commented: “In the current inflationary context I am very pleased that the PEA Update still shows a very robust zinc project with viable economic metrics including an after-tax IRR of 25% and after-tax NPV of C$602 M, as well as significantly increased resources. The new proposed mine plan, with 18% increased tonnage to the mill, could again make Pine Point a top-ten global zinc-lead producer with an annual average production of 329Mlb of zinc and 141Mlb of lead over a 12-year mine life. On a zinc-only basis, Pine Point could potentially become a low-cost zinc-lead producer ranking fourth largest in the Americas. I remind shareholders that the exceptionally clean and high-grade zinc concentrate from Pine Point would be sought after by any number of smelters and traders globally.”

Mr. Wares continued: “This summer we will be drill-testing the best gravity anomaly on the property that resulted from the 2018 gravimetric survey, now that this anomaly has been secured through additional staking. It is our sincere hope that this anomaly represents an undiscovered prismatic deposit of high-grade massive Zn-Pb sulfides. Furthermore, drilling will continue to upgrade the Inferred Mineral Resources on the Project and potentially yield further expansion of several known deposits. We are still very bullish on zinc, especially after seeing an all-time high in spot prices this year, and we are committed to continue developing the Pine Point Project as we launch the feasibility study this fall.”

Hydrogeology Highlights:

- This is the first time a hydrogeological Site Wide Numerical Model (“SWNM”) has been used for the Pine Point Project, providing insight into dewatering requirements.

- The new Cluster mining strategy in combination with the hydrogeological modelling reduced dewatering estimations by 30% on an annual basis for various key Operating and Sustaining Capital Expenditures directly associated to dewatering when compared to mining the open pits individually.

- Current data suggests that there is potentially an additional reduction of up to 15% beyond the current simulation estimates.

- Ongoing modelling will further optimize the LOM plan strategy to pump less water, use less energy, and continue to reduce dewatering costs. This also means reduced NG generated power requirements, and less GHG emissions for a smaller footprint.

- Further optimization of the SWNM and the LOM plan will be a main objective of the feasibility study.

Updated Mineral Resource estimate (MRE) Highlights:

- Indicated Mineral Resource: 15.8Mt grading 4.17% Zn and 1.53% Pb representing approximately 25% of the declared tonnage in the updated 2022 MRE

- Inferred Mineral Resource: 47.2Mt grading 4.43% Zn and 1.68% Pb

- Indicated and Inferred Mineral Resource tonnages increased by 22% and 26%, respectively

- The differences in tonnage/grade between the 2020 and 2022 MRE are attributable to parameter changes used for the pit shells and the cut-off grade calculation.

- The feasibility study will include drilling from 2019 until the end of the drill campaign in H1 2023. This will upgrade the Inferred Resources to the Indicated category for the feasibility study Mineral Resource Estimate.

2022 PEA Update – Detailed cost breakdown

The increase in pre-production CAPEX relative to the 2020 PEA is largely due to a 12% inflation factor, nominally natural gas (“NG”), steel and concrete. Sustaining CAPEX has also increased over the LOM as the mine life was extended by two years. The Company also initiated the use of the Deswik mining software in order to facilitate running various LOM plans, The objective was to compare benefits of using the Cluster mining strategy, that grouped open pit mines in close proximity, to reduce dewatering volumes for the overall Life of Mine (“LOM”) and provide a more accurate operating cost compared to the 2020 PEA.

Using the updated cost inputs (see Table 3), LOM C1 costs (inclusive of smelting and transport) are expected to average $0.61/lb ZnEq and All-in costs (C1 plus smelting, transport and sustaining CAPEX) are estimated at $0.80/lb ZnEq.

Table 2: LOM Capital Cost Summary (in C$M)

| Cost Area | Pre-Production Capital Costs ($M) | Sustaining Capital Costs ($M) | Total Capital Costs ($M) |

| General Administration (Owner’s costs) | 22.8 | 0.0 | 19.1 |

| Underground Mine | 0.0 | 118.3 | 118.3 |

| Open-pit Mine | 15.7 | 80.6 | 96.3 |

| Electricity and Communications | 45.7 | 19.3 | 64.9 |

| Site Infrastructure | 59.7 | 11.8 | 71.5 |

| Process Plant | 297.3 | 0.0 | 297.3 |

| Tailings, Mine Waste and Water Management | 47.7 | 123.6 | 171.3 |

| Indirect Costs | 76.6 | 0.0 | 76.6 |

| Contingency | 87.8 | 18.8 | 106.6 |

| Capitalized Operating Costs | 0.0 | 174.5 | 178.3 |

| Total | 653.3 | 546.8 | 1200.1 |

| Site Reclamation and Closure | 0.0 | 68.0 | 68.0 |

| Salvage Value | 0.0 | -19.6 | -19.6 |

| Total – Forecast to spend (CAPEX + SCAPEX) | 653.3 | 595.2 | 1248.5 |

Table 3: Operating Costs

| Mining Costs (per) | ||

| Surface* | $/Tonne Mined | $3.36 |

| Underground – West Zone** | $/Tonne Mined | $40.01 |

| Underground – Central Zone** | $/Tonne Mined | $52.07 |

| Processing Costs | $/Tonne Milled | $12.27 |

| Power Operating Cost | $/Tonne Milled | $4.61 |

| Waste rock, Tailings and Water Management Costs*** | $/Tonne Milled | $1.63 |

| G&A Costs | $/Tonne Milled | $8.11 |

*LOM Average and inclusive of ore, overburden and waste rock

**Inclusive of transport to the mill

***Previously included in Mining and Processing Cost in the 2020 PEA

Sensitivity

The Pine Point Project is expected to be a robust, profitable operation at a variety of prices and assumptions. Metal prices used in the 2022 PEA Update study are based on weighted two-year moving averages, hence $1.37/lb zinc and $0.96/lb lead.

Under more bullish scenarios, especially when considering record low inventory levels and continued lack of investment in the mining industry, the Project demonstrates even stronger economic returns and is well-positioned to benefit from a higher long-term zinc price. At US$1.50/lb zinc, $1.00/lb lead and FX 1.25, the Project returns an NPV of C$787M with an IRR of 29% on an after-tax basis.

A lower commodity pricing scenario was also modeled using US$1.30/lb zinc, $0.95/lb lead and FX 1.29. Even at lower prices, Pine Point would still generate a robust NPV of C$526M and IRR of 23% on an after-tax basis.

Hydrogeological Modelling

The current dewatering plan was updated for the Project’s PEA Update by HRI using the FeFlow V7 software. This is an important step in the process of better estimating dewatering volumes as it utilizes the Pine Point Project 3D Geological model and GIS Database and is corroborated with Profile Tracer Tests (“PTT”) in 23 holes that were tested until the cutoff date of December 2021. Additional testing is ongoing and will be used to calibrate future simulations.

For the North, Central and East Mill Zones, open pit mines were grouped into clusters measuring 3 kilometers long and 1 kilometer wide. Generally, pits located within a cluster are mined in sequence to reduce dewatering requirements. Utilizing this type of dewatering strategy will help to optimize overall pumping rates and power requirements.

To reduce water management in underground mines in the West Zone, grouting was selected as the preferred water inflow restriction methodology. Discussions with experts and previous employees of Pine Point Mines during the Cominco Ltd. era benefitted the analysis and grouting (till injection) was chosen as the preferred method to reduce water inflow.

Using contemporaneous measurement systems, and dewatering management techniques the Company will continue to optimize mine sequencing, and the overall LOM plan to better manage water. One strategy being used is to evaluate if dewatering the deepest pit within a Cluster area reduces the dewatering of adjacent open pits. The ultimate objective is to focus on each Cluster to maximize mining efficiency and reduce dewatering volumes to manage. This will help to focus on reducing production timelines per open pit and per Cluster, potentially further reducing dewatering volume estimates.

The strategic placement of water wells targeting structures and discontinuities will be an innovative approach never previously applied to Pine Point.

Mining

In the 2022 PEA Update the Pine Point Project LOM plan would still consist of simultaneously mining open pit deposits in the East Mill, Central, North and N204 Zones concurrent with underground operations in the West and Central Zones as in the 2020 PEA.

The overall schedule has changed using the Deswik software platform but the general strategy is the same with an average LOM production rate of 11,250 tonnes per day mined.

The open pit LOM plan is still proposing to mine 47 open pits and 9 underground deposits over a strike length of 50 kilometres, mainly located above 125 metres depth from surface. Most of the deposits are characterized by multiple shallow tabular panels dipping approximately 2-5 degrees towards the West.

The open pit mining method is essentially the same as in the 2020 PEA, incorporating five metre benches in mineralized material, ten metre benches in waste with an overall open pit wall angle of 45 degrees. The mining fleet would include long-haul trucks with a payload of 90 tonnes. The production rate would vary between 8,000 tpd and 11,250 tpd. The strip ratio is lower due to the inclusion of more mineralization and is expected to average 5.6 to 1.

Underground operations would still use 45 tonne haul trucks with ramp access and would produce at a rate of 4,000 tpd in the West Zone and 2,000 tpd in the Central Zone. The mining methods used are a mixture of Long Hole Stoping (85%) combined with Room and Pillar (15%).

Processing and Smelting

The Pine Point processing plant is still designed to treat up to 11,250 tpd Run of Mine (“ROM”) material. The processing plant would consist of a three-stage crushing circuit as well as an XRT-based mineral sorting system that would reject approx. 40% waste material. The sorted concentrate would be blended with the primary crushing circuit fines to feed a ball mill (6,700 tpd) followed by conventional lead and zinc flotation circuits.

Overall zinc and lead recoveries, inclusive of material sorting, over the LOM, are expected to be approximately 87 % and 93%, respectively. Flotation tailings would be thickened and pumped for disposal within mined out pits. The flotation concentrates would be filtered and trucked to Hay River for transloading into rail cars for shipment to smelters.

Pine Point zinc and lead concentrates are not encumbered by any offtake agreements. It is expected that this type of high-quality material would be sought after by most smelters. The forecasted future zinc supply will be dominated by concentrates with high impurities which will require blending with concentrates similar to that of Pine Point.

The Pine Point zinc concentrates are expected to be predominantly smelted in North America using long-term benchmark contract prices with positive adjustments to account for its high-quality. The remaining portion is expected to be sold into both the Asian spot and benchmark contract markets.

Lead concentrates would be mainly sold into the Asian spot and benchmark contract markets with only a minor North American component.

Table 4: Processing Overview

| Crushing and Pre-Concentration Circuit Throughput | 11,250tpd | |

| Coarse Fraction | 70% | |

| Fine Fraction | 30% | |

| XRT Mass Recovery | 42% | |

| Total Mass Recovery (including crusher fines) | 59% | |

| Grinding and Flotation Circuit Throughput | 6,700tpd | |

| XRT LOM Recoveries | ||

| Zinc | 93.4% | |

| Lead | 99.0% | |

| Flotation LOM Recoveries | ||

| Zinc | 92.9% | |

| Lead | 94.1% | |

| Overall LOM Recoveries | ||

| Zinc | 87.0% | |

| Lead | 92.9% | |

Proposed Infrastructure Upgrades and Indirect Costs

The Project is located 60 km east of the town of Hay River in the Northwest Territories, on the south side of Great Slave Lake. Established infrastructure consists of an active power substation, paved GNWT highway access and one hundred kilometres of 25-metre-wide haul roads from the original Cominco era mining operation that provide access to all major deposit areas.

The town of Hay River is serviced by an airport and a paved road from Alberta. The town is also host to a railway head operated by the Canadian National Railway.

The proposed Project would be comprised of 55 mining sites (47 open pits and 8 underground deposits), one central concentrator plant site, and a main electrical substation. The power requirements could also be provided in part by the Northwest Territories Power Corporation through the Taltson hydro-electric grid.

The Project’s power sources are assembled into 3 regional complexes (East-West-Central). This strategy plays an important role in getting the best rates from energy suppliers, maximizing energy efficiency, and helping secure a green and stable electricity feed to the process plant.

The central complex represents about 96% of the total site load and is directly connected to the local power grid that would provide an average 8,300kW of green hydro powered electricity. An extra 2,600kW would be provided by a solar farm installed on site. Having the solar station connected to the local electrical distribution will also add more capacity to the local grid and will increase the reliability of the region’s power supply. Over the LOM, these two energy generation systems will cut the NG consumption by 79% compared to all fossil fuel based solution. The remaining capacity will be provided by a fleet of NG generators.

Overburden stockpiles and waste rock stockpiles would be located nearby planned open pit mines where necessary and waste rock would also be deposited in former historical open pit mines. Overburden and waste rock would also be used for progressive reclamation where appropriate.

There would be no Tailings Management Facility (“TMF”) as certain designated former open pits from the Cominco Ltd. era and future proposed open pits for tailings disposal and then the tailings would be covered by Pre-concentrator reject waste rock material and finally capped with coarser sterile waste rock and then overburden before re-regeneration of vegetation.

Indirect costs such as engineering, procurement and construction management, temporary facilities for construction, and other related items are estimated at $76.6 million. An additional $106.6 million has been budgeted over the LOM as a contingency for specific costs.

Hydrogeological Work Summary

Initially, the Company and HRI compiled existing hydrogeological reports, reference papers, and used the 3D Geological model interpreted from historical and recent drill logs to define the stratigraphic boundaries, including the Sulfur Point Formation, the main host of Tabular mineralization at Pine Point.

The 23 water wells mentioned above, were surveyed using PTT, chemical profiles, slug tests, injection tests and low flow pump tests. The PTT consist of mixing a tracer in the borehole without inducing any stress, followed by the monitoring of tracer dilution over time within each hole. This allows for the accurate identification of water-bearing sources, including structural discontinuities, and allows for better flow characterization and interpretation.

The Chemical profiles that are measured in each of the tested holes give a full downhole measurement survey of water temperature, electrical conductivity, total dissolved solids and water salinity. The PTT also measures changes in water chemistry and often highlights isolated flow zones, confirming the contrast between faults and/or bedding planes when compared to low flow zones.

PTT results continue to indicate that the groundwater flow is preferentially controlled by discrete discontinuities (i.e., faults and/or fracture zones) contrasting from the historical concept of a majority of the flow originating from formational aquifers. Locally, Prismatic high-grade deposits, that were preferentially mined during the Cominco era, are also located within the porous dolomitized Sulfur Point Formation and have associated higher inflow rates since these Prismatic deposits are also associated with the same structural discontinuities discussed above.

Recent structural analyses of all available open pits, combined with 3D drone photography of pit walls, of historical Cominco Ltd. era open pits, were carried out by Terrane Geosciences in 2021. This allowed for the construction of initial structural geology models which are now being combined with the Pine Point Project drill hole database and interpreted stratigraphic off-sets from vertical sections, as well as 3D geological modeling, and the GIS database that includes regional data sources (Magnetic surveys, Gravity Surveys, LIDAR, regional maps, aerial photographs, etc) All of these datasets are used to interpret and locate specific structural features or lineaments within proposed mining areas in an attempt to correlate with regional structural discontinuities.

This will lead to a better understanding of potential water flow conduits and provide for strategically targeted placement of highly efficient water wells. To date, predictable fault trends were identified in historical open pits and correlated with stratigraphy that was off-set in drill holes. This coupled with the SWNM, illustrated that potentially regional structural faults or fault trends are present in the West Zone where proposed underground mines (G03, O556, P499, R190 and X25) are located.

This represents a significant shift from previous interpretations of underground water flow modeling at Pine Point, which was almost exclusively based on the theory that formational aquifer flow within the Sulfur Point Formation and/or the underlying stratigraphy caused the majority of inflow rates.

Site Wide Numerical Model; A Dewatering Overview

The SWNM was built using Feflow V7, a well-known simulation software, the SWNM covers a surface area of approximately 1775 km2, the project area covers 94 kilometers of strike length in an East Northeasterly direction and a 22-kilometre project width in an approximately north-south direction.

It includes all of the proposed open pits and underground mines, as well as all of the historical mines. Two regional faults and zones of hydraulic conductivities were integrated into the SWNM. Calibration of was achieved by comparing historical open pit area inflows to simulated inflows obtained using the SWNM.

Following this, the hydraulic conductivity values were compared to those obtained during recent and historical drillhole testing program. Current overall dewatering volume measurements are approximately in-line with historical dewatering records.

Table 5: Hydrogeological Model Calibration Results

| Open Pit (Name) | Historical Flow (m3/day) | Simulated Flow (m3/day) | Percentage Difference (%) |

| J-44 | 40197 | 41066 | 2% |

| N-42 | 13735 | 11352 | -21% |

| O-42 | 29705 | 23720 | -25% |

| X-15 | 26707 | 23422 | -14% |

| K-57 | 47353 | 52922 | 11% |

| R-61 | 50287 | 70487 | 29% |

| K-62 | 38246 | 40748 | 6% |

| A-70 | 104373 | 93868 | -11% |

| J-69 | 78823 | 71411 | -10% |

| T-58 | 51617 | 52172 | 1% |

| S-65 | 14557 | 34184 | 57% |

| A-55 | 131150 | 138810 | 6% |

| K-77 | 33841 | 32679 | -4% |

| M-64 | 30083 | 36951 | 19% |

| Sum | 690674 | 723792 | +5% |

The simulated results are in the same order of magnitude as the observed flow rates compiled by Stevenson (1984). Therefore, modeling is slightly overestimating inflow by five percent. Open pit S-65 shows the biggest difference between simulated estimates and observed results.

Since there are no historical values of inflow in the West Area of the Buffalo River, comparisons are not possible. Therefore, a pump test was carried out in the West Area, on the R190 deposit, by Vogwill (1981). This historical test result was used to verify the accuracy of the SWNM in this area: Simulated drawdown estimates are comparable to the observed drawdown values, suggesting the calibration of the SWNM is appropriate for the West Area. Following recent field test results in the X25 deposit area, a more isolated numerical model was prepared to better understand the dewatering requirements in this area.

The simulated K values are mostly in the 10-5m/s range, which agrees with field test results and the previous 2021 C1 Cluster model. In comparing the 2021 C1 Cluster test model to the new SWNM simulation model. The results from the SWNM show higher inflow rates in open pits J68 and K68 (twice as high), but also with comparable results for M67 and L65UG. This suggests potential overestimation of the flow in the SWNM. This difference is also attributed to a different and longer mining schedule.

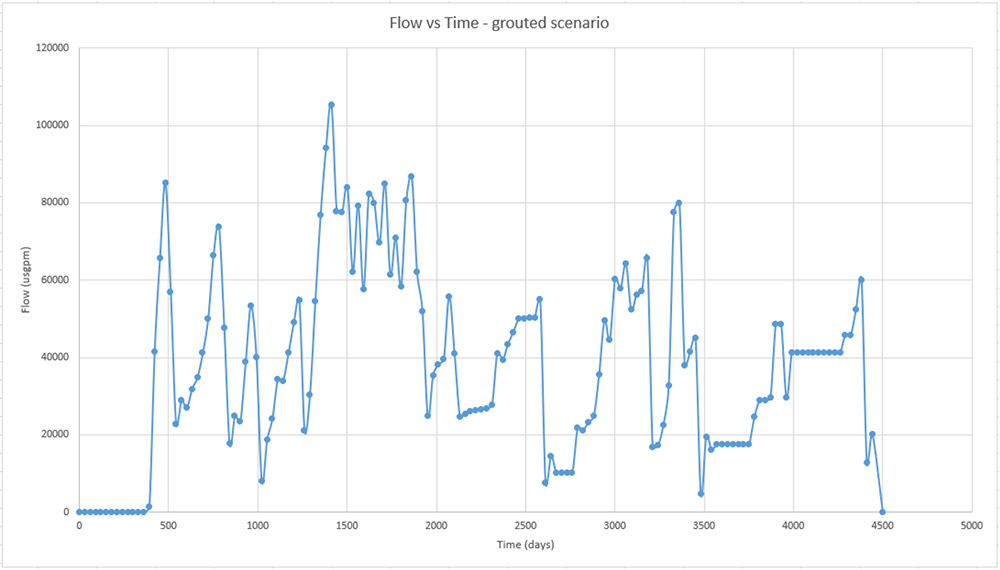

The LOM plan that was used for the SWNM, listed monthly production rates that were provided to simulate monthly inflow rates that maintain water levels at 10m below all operational bench elevations. The evolution of inflow rates is illustrated in the graph below, this considers a grouting strategy in the underground mines located in the West Area.

Figure 1: Inflow Rates vs Time

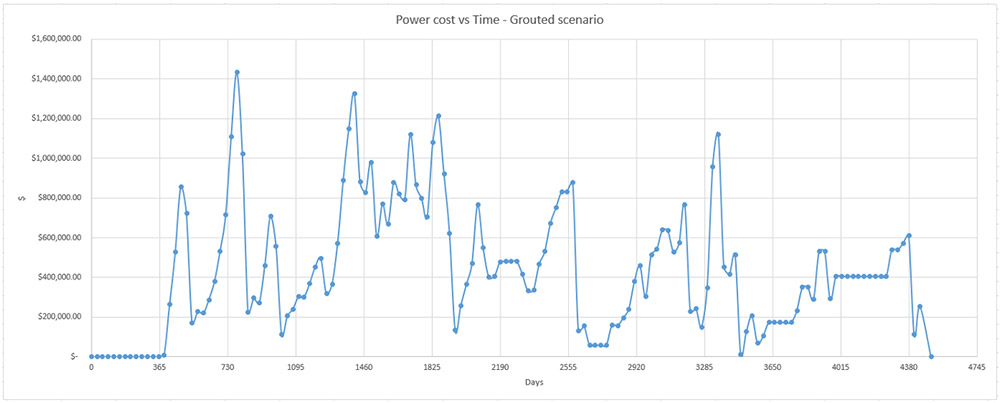

Peak inflows occur in Year 4 and 8 with estimated inflows of 105 000 and 80 000 usgpm respectively. The highest inflow rates are associated with the underground deposits. The following graph illustrates the expected power consumption (in $) based on flow rates and the estimated discharge head, considering 75% pump efficiencies for the wells and 50% efficiency for the underground sumps with a cost per KWh at 0.33$.

Figure 2: Power Cost vs Time

The new Cluster mining strategy combined with the use of hydrogeological modeling reduced the estimated inflow rates by 30% on an annual basis for various key Operating and Sustaining Capital Expenditures directly associated to dewatering when compared to mining the open pits individually in the 2020 PEA, prior to any cost inflation. Current data suggests that there is potentially an additional reduction of up to 15% beyond the current simulation estimates.

These results are partially attributed to using the Cluster mining strategy that was programmed into a mining planning software to highlight opportunities and constraints.

Peak power demand is estimated to occur in Year 4 and 5 in the current LOM plan. Total power consumption for dewatering is estimated to be 66M$ when generating NG power at 0.33$ per KWh. The power is to be used for the dewatering wells, excluding other water transportation requirements.

The current grouting strategy significantly reduced inflow estimates in the West Zone. Trade Off studies will continue during the feasibility study.

This illustrates the importance of the Cluster mining operational strategy of open pits at Pine Point in order to reduce dewatering volumes by using appropriate field data acquisition and simulation methods. Each open pit is evaluated based on the elevation of each production bench with an additional 10m depth margin applied to ensure that blasthole production drilling would be in dewatered material.

Hydrogeological modelling enhancements will be an iterative process going forward in order to optimize the LOM plan strategy that will have an objective to pump less water, use less NG-generated energy, and produce less greenhouse gas emissions for a smaller carbon footprint.

The SWNM will be used during the feasibility study to further optimize the LOM plan and dewatering strategy. Smaller localized models will be built for each Cluster area in the Feflow software where needed to increase accuracy.

The optimization process should further reduce estimated inflow rates and associated power consumption, increasing overall project economics. Ongoing testing will better define aquifer characteristics, focusing on, among other things, the North Zone and underground mines.

Osisko Development Corporation supported the project as the Company’s internal design engineers. They developed the current LOM plan that was used for the hydrogeological study.

Mr. Michael Verreault P.Eng. M.Sc.A., is the Qualified Person for Osisko Metals regarding hydrogeological work. He is a Professional Geological Engineer with a Master’s degree in Hydrogeology, and he is responsible for the technical data reported in this news release.

Greenhouse Gas Emission Assessment

The Company performed a GHG emission assessment for the 12-year LOM operation to understand the overall footprint and identify key aspects of the mine plan and operational plan that could be optimized in the feasibility study to further reduce overall emissions for the Project. The assessment only covers the Scope 1 emissions within the battery limit of the Project site, from extraction activities to loading concentrate on the train to be shipped from the Project to smelters.

The latest operational optimizations, namely the dewatering plan and the power generation strategy, that includes solar energy for peak shaving of the electrical load, has enabled reducing emissions by 3% even though the LOM increased by two years or 10%.

Environment and Closure Plan

All mining projects located in the Northwest Territories are assessed in accordance with the Mackenzie Valley Resource Management Act (“MVRMA”). Environmental assessments are conducted by the Mackenzie Valley Environmental Review Board (“MVEIRB”) and includes all relevant federal agencies, such as ECCC and DFO, as parties to the process.

At the completion of the environmental assessment (“EA”), if the board recommends the Project be approved, the Mackenzie Valley Land and Water Board (“MVLWB”) will process the proponents’ applications for a Water License and Land Use Permit through a public process.

A closure and rehabilitation plan estimate for the Project has been developed by WSP as required by the MVRMA. Reclamation costs were estimated at $68.0 million.

Activities during closure would include the dismantling of the buildings and infrastructure erected for mine operations and for the processing plant, the closure of the tailings deposition areas, waste rock stockpiles and water management infrastructure and the reclamation of other areas that would be disturbed during the life of the Project. This cost estimate includes both the cost of site reclamation as well as post-closure monitoring.

Stakeholder Engagement

The Company is proactively working and consulting with local indigenous and non-indigenous communities that would be impacted by the Project. Consultation on the Project with the communities was initiated in 2017 and has continued with frequent notifications on project activities, meetings, and virtual open house presentations during the pandemic. During the exploration program efforts have been made to offer employment and contracting opportunities whenever possible.

Both the Aboriginal and non-Aboriginal communities have expressed strong support for the Project, with the objective of maximizing the economic benefits for local communities – specifically with a focus on employment and entrepreneurial opportunities throughout the various Project phases.

The realized Project would have a significant impact in the Northwest Territories, with the potential of generating over C$804M in combined federal and territorial tax revenue and contributing approximately 456 well remunerated jobs during the production phase and approximately 395 jobs during the construction period.

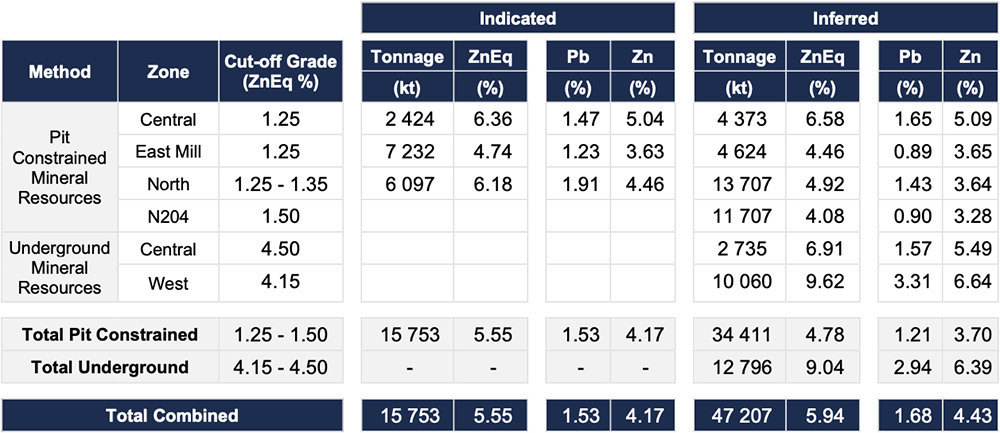

MRE Overview:

All tonnages in Table 6 are rounded to nearest thousand tonnes. ZnEq percentages are calculated using metal prices, forecasted metal recoveries, concentrate grades, transportation costs, smelter payable metals and charges. The pit constrained cut-off grade range is mostly due to the variable transportation distances from the mining zones to the presumed plant site location.

Table 6: 2022 Mineral Resource Estimate for Pine Point

Notes Regarding Mineral Resource Estimate

- The independent qualified person for the 2022 MRE, as defined by National Instrument 43- 101 guidelines, is Pierre-Luc Richard, P.Geo., of PLR Resources Inc. The effective date of the 2022 MRE is March 10,

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in the 2022 MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or However, it is reasonably expected that the majority of Inferred Resources could be upgraded to Indicated Resources with continued exploration.

- Resources are presented as undiluted and in situ for an open-pit and underground scenario and are considered to have reasonable prospects for economic The constraining pit shells were developed using overall pit slopes of 45 to 50 degrees in bedrock and 26.6 degrees in the overburden. Resources show sufficient continuity and isolated blocks were discarded; therefore, the herein 2022 MRE meet the CIM Guidelines published in November 2019.

- The 2022 MRE was prepared using GEOVIA GEMS 6.8.3 and is based on 19,509 surface drillholes and 166,376 samples, of which 7,852 drillholes and a total of 47,998 assays were included in the modeled mineralization. The drillhole database includes recent drilling of 78,195 metres in 1,182 drillholes since 2017 and also incorporates Cominco ’s historical drillholes, the use of which was partially validated by a drillhole collar survey, twinning programs, and a partial core resampling program. The cut-off date for the drillhole database was December 31, 2019. Approximately 35,000m in 550 drillholes were added to the project since the drillhole database cut-off date.

- The 2022 MRE encompasses 254 zinc-lead-bearing zones, each defined by individual wireframes with a minimum true thickness of 2.5 m. A value of zero grade was applied in cases of the core not

- High-grade capping was performed on the composited assay data and established on a per-zone basis for zinc and Capping grades vary from 10% to 35% Zn and 5% to 40% Pb.

- Density values were calculated based on the formula established and used by Cominco during its operational period between 1964 and 1987. Density values were calculated from the density of dolomite, adjusted by the amount of sphalerite, galena, and marcasite/pyrite as determined by metal assays. A porosity of 5% was assumed. Waste material was assigned the density of porous dolomite.

- Grade model resource estimation was calculated from drill hole data using an Ordinary Kriging interpolation method in a percent block model using blocks measuring 10 m x 10 m x 5 m in

- Zinc equivalency percentages are calculated using long-term metal prices indicated below in (10), forecasted metal recoveries, concentrate grades, transport costs, smelter payable metals, andThe estimate is reported using a ZnEq cut-off varying from 1.25% to 1.50% for open-pit resources and 4.15% to 4.50% for underground resources. Variations take into consideration trucking distances from the pit constrained mineralization to the mill and metallurgical parameters for each area. The cut-off grade was calculated using the following parameters (amongst others): zinc price = USD1.30/lb; lead price = USD1.00/lb; CAD:USD exchange rate = 1.27. The cut-off grade will be re-evaluated in light of future prevailing market conditions and costs.

- The 2022 MRE presented herein is categorized as Inferred and Indicated Mineral Resources. The Inferred Mineral Resource category is constrained to areas where drill spacing is less than 100 metres and the Indicated Mineral Resource category is constrained to areas where drill spacing is less than 30 In both cases, reasonable geological and grade continuity were also a criterion during the classification process.

- The pit optimization to develop the resource constraining pit shells was done using Hexagon’s Mine Plan Version 15.8.

- Calculations used metric units (metre, tonne). Metal contents are presented in percent or pounds. Metric tonnages were rounded and any discrepancies in total amounts are due to rounding

- CIM definitions and guidelines for Mineral Resource Estimates have been

- The QP is not aware of any known environmental, permitting, legal, title-related, taxation, sociopolitical, or marketing issues, or any other relevant issues that could materially affect the 2022

Cautionary Statement

The reader is advised that the PEA summarized in this press release is preliminary in nature and is intended to provide an updated high-level review of the project’s economic potential and design options. The PEA Update mine plan and economic model includes numerous assumptions and the use of Inferred Mineral Resources. Inferred Mineral Resources are considered to be too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that further work will result in the definition of economic mineral reserves at Pine Point.

Independent Qualified Persons

This PEA was prepared for Osisko Metals by BBA Inc, WSP Canada Inc., and other industry consultants, all Qualified Persons (“QP”) under National Instrument 43-101. The study was coordinated by the Company’s Project Manager Xavier Pouchain PMP in collaboration with the Osisko Development Technical Services Group.

The independent QPs have reviewed and approved the content of this press release and they include:

Colin Hardie, P.Eng., (BBA Inc.)

Pierre-Luc Richard, P. Geo. (PLR Resources Inc.)

Zakaria Moctar, P. Eng., (WSP inc.)

Paul Gauthier, P. Eng., (WSP Inc.)

Trent Purvis, P. Eng., (WSP Inc.)

Simon Latulippe, P. Eng., (WSP Inc.)

Michael Verreault, P. Eng., M.Sc.A. (Hydro-Ressources Inc.)

About Osisko Metals

Osisko Metals Incorporated is a Canadian exploration and development company creating value in the critical metal space. The Company controls one of Canada’s premier past-producing zinc mining camps, the Pine Point Project, located in the Northwest Territories for which the 2022 PEA has indicated an after-tax NPV of $603M and an IRR of 25%. The Pine Point Project PEA is based on current Mineral Resource Estimates that are amenable to open pit and shallow underground mining and consist of 15.7Mt grading 5.55% ZnEq of Indicated Mineral Resources and 47.2Mt grading 5.94% ZnEq of Inferred Mineral Resources. Please refer to the technical report entitled “Preliminary Economic Assessment, Pine Point Project, Hay River, Northwest Territories, Canada” dated July 30, which has been filed on SEDAR. The Pine Point Project is located on the south shore of Great Slave Lake in the Northwest Territories, near infrastructure, paved highway access, and has an electrical substation as well as 100 kilometres of viable haulage roads already in place.

The Company also hold a 100% interest in the past-producing Gaspé Copper property located near Murdochville in the Gaspé peninsula of Quebec including the Mount Copper Expansion Project which is host to a NI43-101 Inferred Resource of 456Mt grading 0.31% Cu. The Mount Copper Expansion Project is the largest untapped copper resource in Eastern North America, strategically located near existing infrastructure in the mining-friendly province of Quebec. For further information on this press release, visit www.osiskometals.com or contact:

Robert Wares, CEO of Osisko Metals Incorporated

Email: info@osiskometals.com

Cautionary Statement on Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation based on expectations, estimates, and projections as of the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events, or performance are not statements of historical fact and constitute forward-looking information. This news release may contain forward-looking information about the Pine Point Project, including, among other things, the results of the PEA and the IRR, NPV and estimated costs, production, production rate, and mine life; the expectation that the Pine Point Project will be a robust operation and profitable at a variety of prices and assumptions; the expected high quality of the Pine Point concentrates; the potential impact of the Pine Point Project in the Northwest Territories, including but not limited to the potential generation of tax revenue and contribution of jobs; and the Pine Point Project having the potential for mineral resource expansion and new discoveries. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management, in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, including, without limitation, assumptions about: favourable equity and debt capital markets; the ability to raise additional capital on reasonable terms to advance the development of its projects and pursue planned exploration; future prices of zinc and lead; the timing and results of exploration and drilling programs; the accuracy of mineral resource estimates; production costs; operating conditions being favourable; political and regulatory stability; the receipt of governmental and third-party approvals; licenses and permits being received on favourable terms; sustained labour stability; stability in financial and capital markets; availability of equipment; and positive relations with local groups. Forward-looking information involves risks, uncertainties, and other factors that could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information are set out in the Company’s public documents filed at www.sedar.com. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events, or otherwise, other than as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accept responsibility for the adequacy or accuracy of this news release.