(Montreal, April 28, 2022) Osisko Metals Incorporated (the “Company” or “Osisko Metals“) (TSX-V: OM; OTCQX: OMZNF; FRANKFURT: 0B51) is pleased to announce an initial Inferred Mineral Resource Estimate at Mount Copper as part of the Gaspé Copper Project, located near Murdochville in the Gaspé Peninsula of Quebec. This resource is pit-constrained to mineralization surrounding the past-producing Mount Copper open pit mine (“Mount Copper Expansion Project”) and uses a base case of US$3.80/lb copper and a lower cut-off grade of 0.16% sulfide copper. It was estimated using data from historical drilling completed between the 1960’s and 2019.

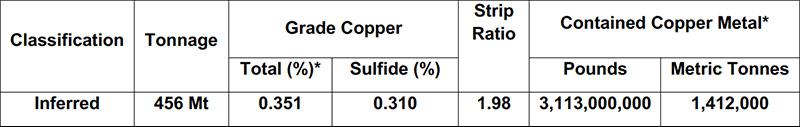

Table 1: Mineral Resource Estimate Base Case

- The Independent QP for this Mineral Resource Estimate statement is Yann Camus, P.Eng., Geological Services of SGS Canada Inc.

- The effective date is April 12, 2022.

- CIM (2014) definitions were followed for Mineral Resource Estimate.

- No economic evaluation of the Mineral Resource Estimate has been produced.

- SGS is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issues that could materially affect the Mineral Resource Estimate.

- All reported figures are rounded to reflect the relative accuracy of the estimate. Totals may not add up due to rounding.

- *Total copper includes acid-soluble oxidized copper plus sulfide copper. Contained copper includes sulfide copper only.

Highlights:

- At 1.41 million tonnes (3.1 billion pounds) of contained copper, the Mount Copper Expansion Project hosts the largest untapped copper resource in Eastern North America, strategically located near existing infrastructure in the mining-friendly province of Quebec.

- The mineralization geometry surrounds the former open pit mine with a strip ratio that is currently estimated at 1.98.

- The Whittle pit-constrained Mineral Resource Estimate is limited to the sulfide copper mineralization only that surrounds the Mount Copper historical open pit. All oxide mineralization is being treated as zero value waste at the present time.

- The current 30,000 metre drill program may reduce strip ratio, reduce the oxide/sulfide ratio in the resource model and hence improve the sulfide grade. Additionally, potential for by-product silver and molybdenum exists and will be defined with the current drill program.

Robert Wares, CEO & Chairman of the Board, commented: “We are extremely pleased to announce a maiden Inferred Mineral Resource Estimate for the Mount Copper Expansion Project. This is the first step for our comprehensive strategy at Gaspé Copper to fully evaluate all potential for economic copper deposits remaining within this past-producing porphyry copper/skarn complex. We strongly believe this large-scale asset could become a core component of Quebec’s critical mineral development strategy that aims to provide essential metals for global decarbonization initiatives. Our 30,000-metre drill program has begun with the objective of refining sulfide/oxide ratios in the deposit and upgrading the Mineral Resource Estimate to the Measured & Indicated categories by year end. Furthermore, we will immediately launch a Preliminary Economic Assessment (PEA) on the Mount Copper Expansion Project and look forward to rapidly developing this asset in partnership with Glencore Canada.”

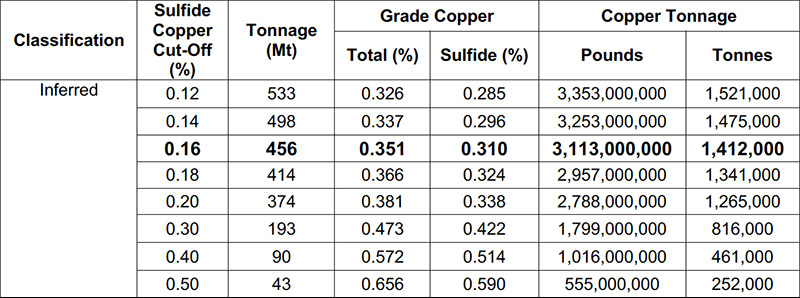

Mineral Resource Sensitivity

The following table shows the resources reported at various reasonable cut-off grades, the base case cut-off grade is 0.16% copper and shown in bold:

Table 2: Mineral Resource Estimate at Variable Cut-Off Grades

Same footnotes as Table 1 apply to this table.

Potential for Additional Mineral Resources at Gaspé Copper

End-of-mine, existing historical mineral resources at Gaspé Copper that are not NI43-101 compliant are reported in Noranda/Falconbridge Annual Reports 1998-2000, Quebec government mining assessment reports and in Hussey & Bernard (SME Aug 1998, p. 36-44). Regulatory authorities require that disclosure of historical resources by an issuer must be referenced, along with other requirements, by publicly available technical reports, and such reports on the historical estimates are not available. The following disclosure therefore describes the remaining mineral deposits and areas of mineralization at Gaspé Copper and the Company believes that these offer excellent potential for additional resources. Osisko Metals’ strategy at the present time is to focus on the economic viability of the Mount Copper sulfide resource only, and if this can be achieved, evaluation of the potential resources offered below will follow with additional drill programs.

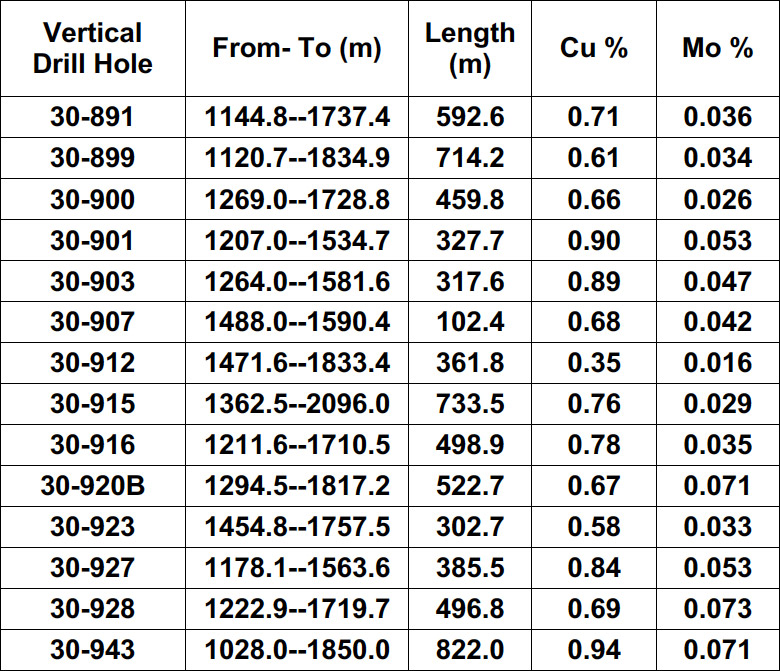

Deep bulk-tonnage target at Porphyry Mountain

The deep-seated Porphyry Mountain deposit was discovered by Noranda Inc. in 1994. Porphyry-style stockwork Cu-Mo mineralization forms a roughly vertical, cylindrical deposit (approx. 800 m high, 400 m long and 350 m wide) that is located deep under Porphyry Mountain (located 1250 metres NE of the center of the Mount Copper open pit), at depths between 1200 and 2000 metres. The deposit remains open at depth. Approximately 24 subvertical holes were drilled into the deposit between 1994 and 2011, and significant intersections include:

Table 3: Significant historical drill intersections, Porphyry Mountain

Oxide stockpiles

Previous mining at the Mount Copper open pit resulted in the stockpiling of oxidized copper mineralization approximately 1100 metres to the NW of the center of the open pit. The stockpiles cover an area measuring 470,000 square metres with an average height of 25 metres. This material is potentially amenable to heap leaching and SX-EW recovery techniques and could eventually represent a low-cost opportunity for additional copper production if a heap leach operation can be successfully permitted.

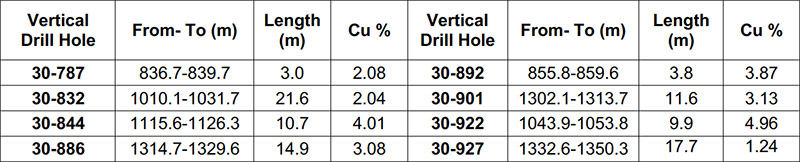

High-grade Residual Mineralization Near Past Underground Operations

Residual underground skarn mineralization still remains in the form of pillars in the mined portion of the C Zone (grades of 1.5% to 2% copper), as well as massive sulfide/skarn mineralization in the deeper E Zone (grades of 3% to 4% copper) with residual resources reported in the E-38 zone. Furthermore, significant historical drill intersections scattered within the 1600-metre-wide E Zone skarn aureole received limited follow-up and offer potential for further resource definition (reported intersections reflect true thicknesses):

Table 4: Significant historical drill intersections, E Zone, outside mined-out areas

Parameters and criteria used for the Mineral Resource Estimate

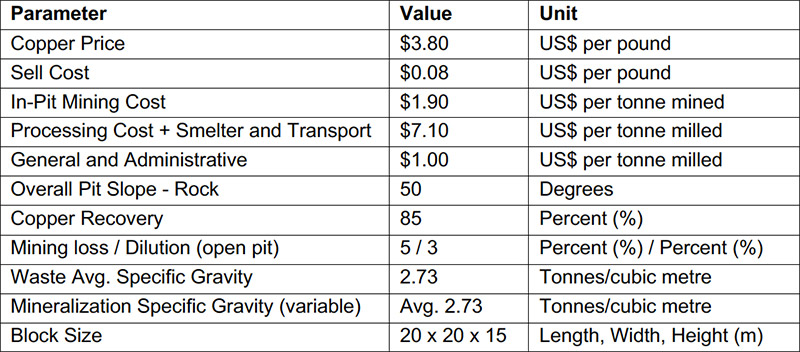

- General Whittle Pit Parameters Used for the Mineral Resource Estimate include:

- The database used in the estimate (in the vicinity of Mount Copper) contains approximately 3,353 drill holes; 283 were deemed unreliable and were rejected. A subset of 641 drill holes were used for the Mineral Resource Estimate with associated composites generated in them. Drill hole data included Noranda (1998 and earlier), Xstrata (2011-2012) and Glencore Canada (2019). Verification of the data has been possible mostly by verifying the coherence of the information but not its correctness; original logs and laboratory certificates were only available for 2011, 2012 and 2019 drill holes.

- Composites of 4 metres were created inside the mineralization volume. A total of 27,895 composites were generated with an average grade of 0.34 %Cu; the composites were capped at 1.80 % total Cu (the copper contained in both sulfides and oxides).

- Cut-off grades are based on a long-term copper price of US$3.80 per pound and a copper recovery of 85%.

- Pit constrained Mineral Resources are reported at a cut-off grade of 0.16 %Cu in sulfide within a conceptual pit shell for the base case.

- Specific gravity values were estimated using data available in the historical drill holes; the average value is 2.73 tonnes/cubic metre.

- The deepest in-pit Mineral Resources reported are at a depth of approximately 600 metres.

- Drilling data was obtained from Osisko Metals and Glencore Canada Corporation. SGS modelled the mineralization on benches and then meshed it as a volume. The maximum distance between drillholes in the pit volume is approximately 350 metres.

- A block model was created with blocks of 20x20x15 m under the current topographic surface and inside the modeled mineralization. Both ordinary kriging (OK) and inverse square distance (ID2) interpolation methods were tested, resulting in no material difference in the Mineral Resource Estimates. Kriging was retained for this estimation.

- The whole database reports total copper, and soluble copper data that are only available for 32 drill holes drilled between 2011 and 2019. It was estimated for the purposes of this report that only the copper contained in sulfides could have economical potential. Therefore, the soluble copper as oxides was removed and significant oxidized zones are all located in the south-west portion of the deposit. The proportion of the copper contained in oxides relative to sulfides is highly correlated to the depth of the mineralization. Therefore, depth from original topographic surface was modeled and used to estimate the percentage of copper contained in oxides for the whole resource estimation.

As recent (post-2011) drilling is almost entirely located in one area of the pit-constrained resource, it is SGS’ recommendation that additional infill drilling be completed across the entire pit volume to 1) improve the oxide model and 2) allow for conversion from the Inferred category to the Measured and Indicated categories.

Cautionary Statement Regarding Mineral Resources

The mineral resources disclosed in this press release conform to NI43-101 standards and guidelines and were prepared by independent qualified persons. The above-mentioned mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of the reported Inferred Mineral Resources are conceptual in nature and are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade and/or quality of continuity. An Inferred Mineral Resource has a lower level of confidence relative to a Measured or Indicated Mineral Resource and constitutes an insufficient level of confidence to allow conversion to a Mineral Reserve. It is reasonably expected, but not guaranteed, that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resources with additional drilling. The National Instrument 43-101 Technical Report, including the mineral resources for the Gaspé Copper Project contained in this news release, will be delivered and filed on SEDAR by Osisko Metals within 45 days of the date of this news release.

Qualified Person

The Mineral Resource Estimate and technical information in this news release has been prepared and approved by Yann Camus, P.Eng., Geological Services of SGS Canada, an independent Qualified Person in accordance with National Instrument 43-101 standards. The Mineral Resource Estimate was reviewed internally by Guy Desharnais, Ph.D., P. Geo., non-independent Qualified Person in accordance with National Instrument 43-101 standards. Technical information relating to other copper deposits at Gaspé Copper has been reviewed by Jeff Hussey, P. Geo. and President of Osisko Metals, a non-independent Qualified Person in accordance with National Instrument 43-101 standards.

About Osisko Metals

Osisko Metals Incorporated is a Canadian exploration and development company creating value in the critical metal space. The Company controls one of Canada’s premier past-producing zinc mining camps, the Pine Point Project, located in the Northwest Territories for which the 2020 PEA has indicated an after-tax NPV of $500M and an IRR of 29.6%. The Pine Point Project PEA is based on current Mineral Resource Estimates that are amenable to open pit and shallow underground mining and consist of 12.9Mt grading 6.29% ZnEq of Indicated Mineral Resources and 37.6Mt grading 6.80% ZnEq of Inferred Mineral Resources. Please refer to the technical report entitled “Preliminary Economic Assessment, Pine Point Project, Hay River, Northwest Territories, Canada” dated July 30, which has been filed on SEDAR. The Pine Point Project is located on the south shore of Great Slave Lake in the Northwest Territories, near infrastructure, paved highway access, and has an electrical substation as well as 100 kilometres of viable haulage roads already in place.

Furthermore, the Company has an option to purchase, from Glencore Canada, a 100% interest in the past-producing Gaspé Copper property located near Murdochville in the Gaspé peninsula of Quebec (see details in March 28, 2022 press release for details).

For further information on this press release, visit www.osiskometals.com or contact:

Robert Wares, CEO, Osisko Metals, tel. 514-940-0670 ext. 111

Email: info@osiskometals.com

www.osiskometals.com

Cautionary Statement on Forward-Looking Information

This news release contains “forward‐looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the potential acquisition of Gaspé Copper; the timing and ability of the Company to exercise the option to acquire Gaspé Copper(if at all); the results of exploration and economic evaluation work completed by Osisko Metals on Gaspé Copper ad Pine Point; the significance (if any) of Gaspé Copper and Pine Point being past producers and the results of such past production; the timing and ability of the Company to obtain regulatory approvals, including the approval of the TSX Venture Exchange, for any transaction and any other information herein that is not a historical fact may be “forward-looking information”.

Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are intended as forward-looking information.

This forward-looking information is based on reasonable assumptions and estimates of management of the Company, at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties or other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the ability of the Company and other parties to negotiate and execute agreements; volatility in the trading price of common shares of the Company; risks relating to the ability of the Company to obtain regulatory and shareholder approvals, as required; ability of Osisko Metals to complete further exploration activities; property interests; the results of exploration activities; risks relating to mining activities; the global economic climate; long-term metal price assumptions; dilution; environmental risks; changes in the tax and regulatory regime; community and non-governmental actions; and those risks set out in the Company’s public documents filed on SEDAR (www.sedar.com) under Osisko Metals’ issuer profile. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot guarantee shareholders and purchasers of securities of the Company that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Company nor any other person assumes responsibility for the accuracy and completeness of any such forward looking information. The Company does not undertake, and assumes no obligation, to update or revise any such forward looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.